MAKE A MEME

View Large Image

| View Original: | Fractional-reserve banking with varying reserve requirements.gif (631x429) | |||

| Download: | Original | Medium | Small | Thumb |

| Courtesy of: | commons.wikimedia.org | More Like This | ||

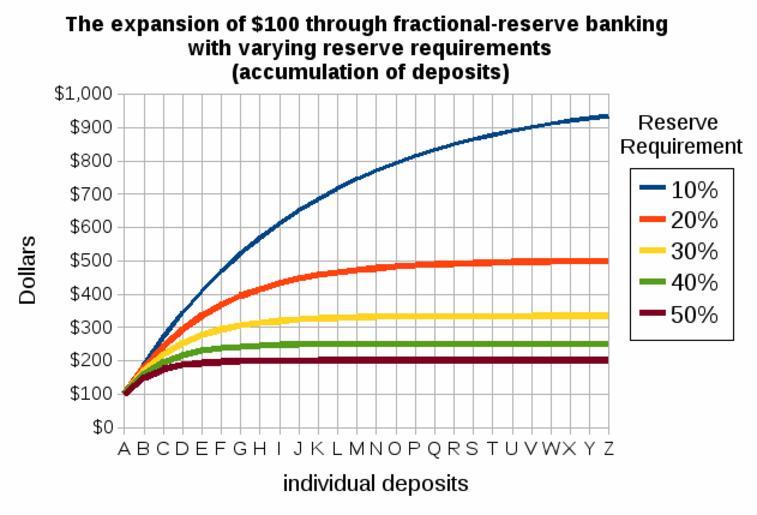

| Keywords: Fractional-reserve banking with varying reserve requirements.gif of the process on this page http //www newyorkfed org/aboutthefed/fedpoint/fed45 html It says Reserve requirements affect the potential of the banking system to create transaction deposits If the reserve requirement is 10 for example a bank that receives a 100 deposit may lend out 90 of that deposit If the borrower then writes a check to someone who deposits the 90 the bank receiving that deposit can lend out 81 As the process continues the banking system can expand the initial deposit of 100 into a maximum of 1 000 of money 100+ 90+81+ 72 90+ 1 000 In contrast with a 20 reserve requirement the banking system would be able to expand the initial 100 deposit into a maximum of 500 100+ 80+ 64+ 51 20+ 500 Thus higher reserve requirements should result in reduced money creation and in turn in reduced economic activity Own Analoguni 2008-08 Macroeconomics Finance International economics | ||||